Administering a trust or estate involves more than simply distributing assets—it requires legal precision, financial oversight, and a deep understanding of Florida probate and trust laws. At Paul Salver, P.A., we help clients manage every detail of the trust and estate administration process with clarity, care, and efficiency.

Whether you are a trustee, personal representative, or beneficiary, our firm offers experienced support to ensure that the estate is settled correctly and in accordance with the decedent’s wishes and state law.

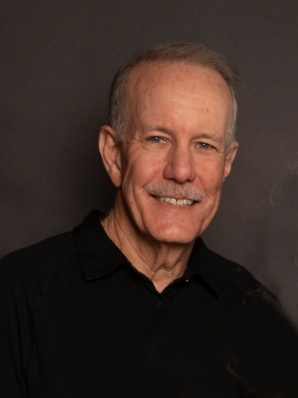

Paul Salver, Esq. offers comprehensive legal services for trustees and estate representatives, ensuring each step is completed lawfully and with attention to detail. Services include:

We advise and assist fiduciaries in fulfilling their duties responsibly—helping avoid legal risks and personal liability.

We assist in identifying, collecting, and valuing estate or trust assets, and provide guidance on proper management during administration.

As both an attorney and CPA, Paul provides insight into federal and Florida-specific tax obligations, including estate tax, income tax, and filings for trusts.

We ensure clear communication with heirs and beneficiaries and oversee asset transfers in compliance with the will, trust, and applicable laws.

If disagreements arise—such as will contests or issues with asset distribution—we work to resolve matters efficiently while protecting your legal rights.

Paul offers a strong command of Florida probate and trust regulations, ensuring every matter is handled accurately and efficiently

With dual expertise in law and accounting, Paul provides comprehensive solutions that address both legal obligations and financial complexities.

Clients appreciate his personal approach and clear communication during emotionally sensitive and often stressful times.

Trust and estate administration is the legal process of managing a deceased person’s assets, paying any outstanding debts or taxes, and distributing the remaining assets to heirs or beneficiaries. This may include:

Identifying and valuing assets

Reviewing and interpreting wills and trust documents

Paying final expenses and settling debts

Filing required tax returns

Distributing assets according to the terms of a will or trust

Handling disputes or challenges, if they arise

The process can be simple or complex, depending on the size of the estate, the type of assets, and the number of beneficiaries involved.

Paul Salver, Esq. provides reliable, detail-oriented probate representation tailored to your unique situation. As both an attorney and a CPA, Paul offers a rare combination of legal and financial insight, helping clients navigate the probate process with ease and assurance.

We understand that each estate is unique. Our team provides tailored advice to meet the specific needs of each client, ensuring a smooth administration process.

From validating wills and trusts to managing asset distribution and addressing tax implications, we handle all aspects of estate administration with diligence and care.

We prioritize keeping our clients informed at every stage, offering clarity and transparency throughout the administration process.

Trust and Estate Administration is the process of managing and distributing a person’s assets after they pass away, according to their will or trust. It involves making sure their final wishes are carried out legally, fairly, and efficiently.

Contact Paul Salver for trust and estate management because he offers clear, reliable guidance to help you administer assets efficiently, comply with Florida law, and avoid costly mistakes. With his legal and financial expertise, Paul ensures every detail is handled with care, professionalism, and integrity.

(954) 292-6339

We invite you to call or email Paul Salver, PA, for probate, trusts, and estate planning needs.

At Paul Salver, P.A., we are trusted, experienced, and fully committed to protecting your legacy with integrity and care.